Most non-profit organizations are 501(c)(3) organizations, which are prohibited by the IRS from participating in partisan politics such as endorsing particular candidates and parties. What many of these organizations don’t know is just how much lobbying on specific legislation they are allowed to do. Earlier this month, Action Circles had experts from the Alliance for Justice for a webinar on the amount and types of lobbying that nonprofits can do. One of the striking things they said was that non-profits should be lobbying, should be affecting legislation, because many of the issues that non-profits exist to address are not being lobbied around by anyone else. Below are some key points from that presentation, as well as links for further information.

What Counts as Lobbying?

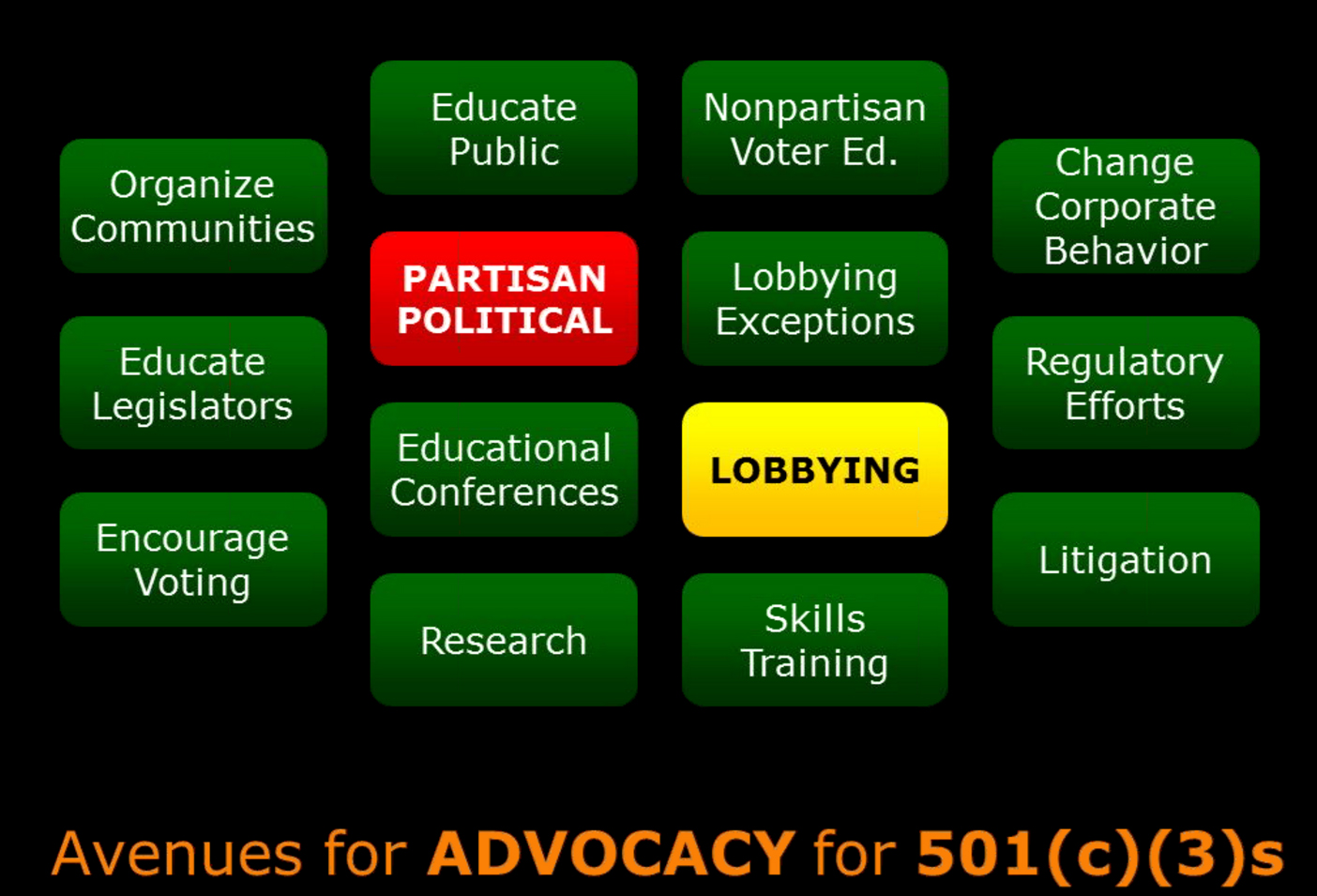

Organizations can do many things that don’t count as lobbying to affect policy, such as:

- educating the public,

- encouraging non-partisan voter registration and turnout, and

- even educating legislators on an issue so long as a specific stance isn’t being advocated.

So when is my organization lobbying? It varies slightly based on whether you are lobbying a legislator, or grassroots lobbying (the IRS limits for spending is different for each as well – that’s covered below).

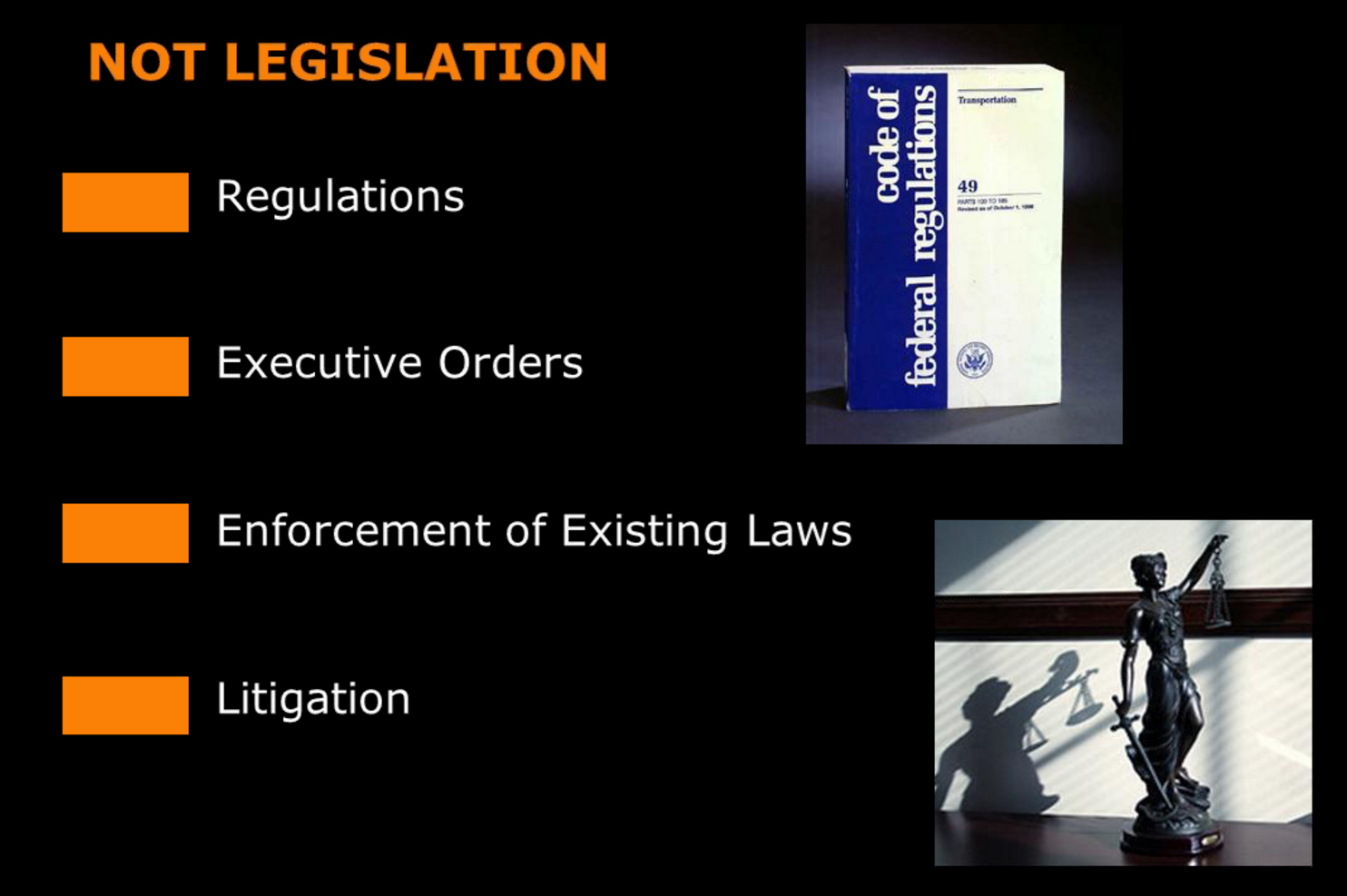

Who is a legislator changes in various situations. House and Senate members on the state or federal level and some local officials are legislators, but executive branch members usually are not unless they are acting in a legislative capacity such as signing or vetoing a bill. When lobbying on a ballot measure, referendum, or constitutional amendment, the general voting public counts as a legislative body. One is lobbying a legislator if they are expressing a view about specific legislation – something that has been introduced, has a bill number, etc. – including budgets and even resolutions. For reporting purposes, preparation for lobbying counts as lobbying as well; often this would be staff time spent preparing or meetings crafting a stance, for instance.

An interesting note: again, if you’re offering facts and information to a legislator without offering an opinion on a specific bill, that isn’t lobbying; however, if you’re educating them so that you can work out your stance for future advocacy for or against a specific bill, then that meeting probably would count as lobbying.

In grassroots lobbying, your audience is the general public – print ads, mailings, rallies, posters – and the same elements must be there for it to count as lobbying, with one extra requirement: a call to action. Your message to the public must express a view on specific legislation and ask the public to contact their legislators, or give the means to do that; telling them who their legislators are, providing contact information, hosting online forms that generate email to legislators.

How should my organization track our lobbying expenses?

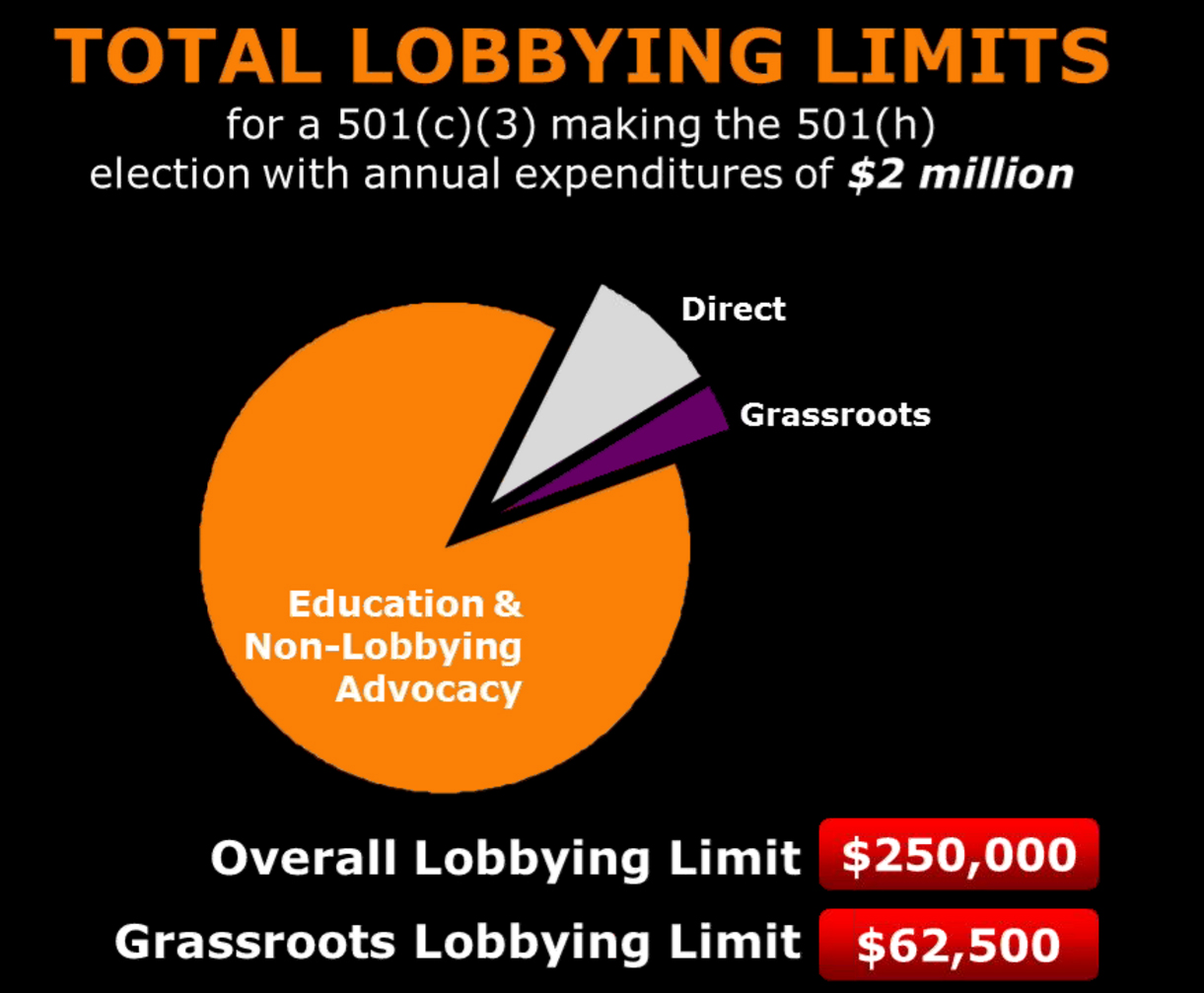

The IRS limits on lobbying refer only to an organization’s expenses as a percentage of their total budget. There are two methods for proving that an organization has not surpassed its limit: the Insubstantial Part Test or the 501(h) Expenditure Test. Alliance for Justice suggests that everyone elect to use the 501(h) guidelines for reporting, which can be done by filling out a one-time form, IRS form 5768. With the Insubstantial Part Test, lobbying expenditures are reported on an organization’s 990.

501(h) provides better definitions for lobbying and specific, dollar-based, limits. Because it is only concerned with expenditures, volunteer time for lobbying activities doesn’t factor in. The limit for grassroots lobbying expenditures is 25% of the limit for overall lobbying expenditures.

How about teaming up with other organizations?

Coalitions are legal, and an effective way to leverage advocacy. Non-profits can join with 501(c)(4) organizations, unions, trade associations, and more to work on issues, but a few considerations must be made. A non-profit should ask itself: Is this coalition engaged in activities that we would be allowed to do on our own as a 501(c)(3)? Restrictions apply whether the organization is working on its own or as part of a group. A 501(c)(4) organization can do anything a 501(c)(3) organization can do, and more, and usually will have more resources; this is something to think about when considering how resources will be shared in a coalition.

Regardless of the nature of the alliance, keeping good paperwork (records of how decisions were made, parameters of working together, expenditures…) is important. In the future, it can be used to show that the organization was not using 501(c)(3) dollars for inadmissible activity.

Are there Vermont-specific laws, too?

Yes, Vermont requires disclosure of State lobbying, under specific circumstances. Their definitions differ from the IRS; for example, they include administrative action. For more information, read the Guide from the VT Secretary of State.